Posted Mon, Feb 21, 2022 6:44 PM

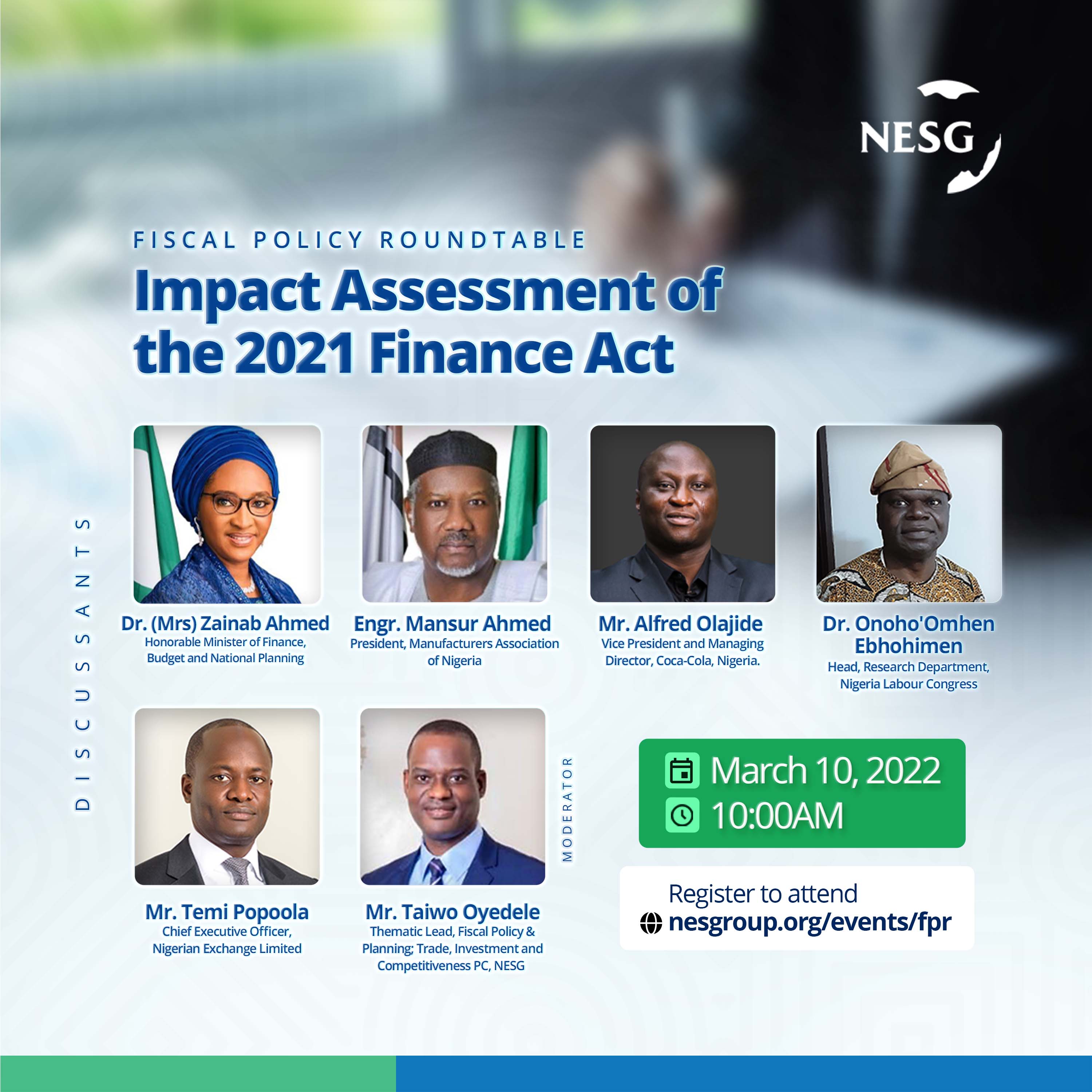

Timeframe: Thu, Mar 10, 2022 3:00 PM - Thu, Mar 10, 2022 5:00 PM

Impact Assessment of the 2021 Finance Act

There is a need to close the widening fiscal gaps in the face of high fiscal deficits and debt stocks in Nigeria (Rewane, 2022). This is being currently pursued by efforts to generate more revenue, particularly from non-oil sources. The Finance Act is one of the direct policy tools intended for domestic revenue mobilization. For the fiscal year 2022, the projected revenue is N10.71 trillion which is 32% higher than the 2021 budget. To meet rising revenue projections, the 2021 Finance Act introduced ‘new’ taxes and increased some tax rates. For instance, the Education Tax rate was raised from 2% to 2.5% while the excise tax was extended to non-alcoholic beverage drinks. These tax changes point to restrictive fiscal measures.

A policy issue then arises: should restrictive fiscal rules be pursued in an economy under-recovery? The policy dilemma is how government can raise more revenue to fund the budget at a time when businesses are grapling with rising costs and dwindling demand. What policy measures are needed to mobilise revenue without stifling investment and economic growth?

There is therefore the need for an evidence-based assessment of the impact of the tax measures as presented in the 2021 Finance Act. This would include the likely direct and indirect effects of the Act coupled with its likely micro and macro impact on the economy. There is also a need to identify loopholes if any and articulate measures that can help policymakers in designing subsequent Finance Acts.

As such, the Fiscal Policy Roundtable will thus engage relevant stakeholders to assess the likely impact of the 2021 Finance Act on households, firms, sub-Sectors, and the macroeconomy at large.

Find an event

Latest Releases

Taxing the Fruits, Not the Seed .. Read

17 hours ago

The 2025 Nigerian Tax Reform Act .. Read

1 day ago

Enabling Enterprise: Success Too .. Read

6 days ago